BLOG

天圖觀點

Post-Pandemic Era: The Current State of U.S. E-Commerce

2020-11-30

The COVID-19 pandemic has significantly impacted people’s lives, causing major shifts in previously familiar lifestyles. While many industries have suffered severe setbacks, e-commerce has been one of the few to thrive. In this edition of “Atlas Perspectives,” we examine the U.S. market and global e-commerce leader Amazon, analyzing the state of U.S. e-commerce before and after the pandemic. We aim to offer brands innovative strategic insights for navigating the post-pandemic era.

1. U.S. E-Commerce Industry Overview: Accelerated Online Growth

The overall U.S. e-commerce market saw substantial growth during the pandemic. In the first half of 2020, revenue reached $347.26 billion, a 30.1% increase compared to the same period in 2019—far exceeding the previous year’s growth rate of 12.7%. Online e-commerce sales accounted for 18.6% of total retail sales in the first two quarters of 2020.

In Q2 2020, U.S. retailers spent $200.72 billion on e-commerce infrastructure, such as website maintenance and order processing—a 44.4% increase compared to Q2 2019. During this period (April to June), one out of every five dollars in retail spending came from online orders. E-commerce penetration reached 20.8%, up from 14.7% in Q2 2019 and 16.2% in Q1 2020.

2. Curbside Pickup: A Rising Service Model

Curbside pickup—where businesses deliver products directly to customers’ cars—has seen a dramatic rise during the pandemic. By August 2020, 43.7% of Fortune 500 retailers offered curbside pickup, a significant increase from 6.9% at the end of 2019.

Major retailers that had already implemented curbside pickup, such as Target Corp. and Home Depot Inc., reported significant revenue growth in Q2 2020.

- Target Corp. (ranked 12th in the Fortune 500) saw online curbside orders grow 734% year-over-year by August 1.

- Home Depot Inc. (ranked 5th) reported triple-digit growth in curbside deliveries by August 2.

3. Amazon: Strengthening Its Position as an E-Commerce Giant

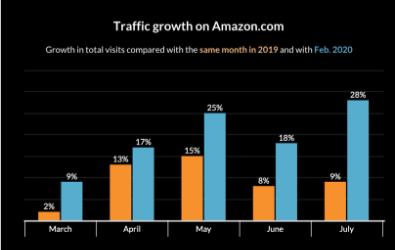

According to Digital Commerce 360’s analysis of traffic data from measurement firm SameWeb, U.S. Amazon site traffic increased by 28.1% in July 2020 compared to February 2020 and grew 8.7% year-over-year. This was notable despite Amazon delaying its annual Prime Day sale to the fall of 2020.

The top five product categories driving Amazon’s e-commerce growth were:

- Food & Groceries

- Electronics

- Household Goods

- Toys & Games

- Gardening Supplies

These categories reflect the pandemic’s significant influence on consumer habits. Notably, apparel, which traditionally dominates e-commerce rankings, was absent from the list as consumers redirected spending toward essentials. The rise of gardening supplies reflects a new pandemic-driven hobby, as lockdowns encouraged people to spend time cultivating their gardens—especially common in households with lawns or small outdoor spaces.

When comparing monthly traffic with both February 2020 and the same months in 2019, the data reveals a clear transformation in U.S. consumer behavior. Even as restrictions eased, the percentage of consumers shopping online continued to grow, highlighting the pandemic’s irreversible impact on purchasing habits.

Conclusion

The U.S. e-commerce industry has experienced significant growth in revenue, sales volume, and website traffic due to the pandemic. This demonstrates how COVID-19 has fundamentally changed consumer behavior, accelerating the shift toward online sales. As brands adapt to this new reality, the e-commerce market is poised for further transformation. The future holds exciting changes—let’s wait and see how it unfolds.

後疫情時代:美國電商發展現況

新冠肺炎疫情的爆發,大幅地影響了人民的生活,許多我們本來習以為常的生活型態在疫情過後正經歷巨大的轉變。疫情影響經貿,而全球有相當多的產業都受到巨大的負面衝擊,但電商卻是少數得益的產業。本篇「天圖觀點」就以電商大國的美國和全球龍頭電商Amazon為標的,分析疫情前後美國電商發展的概況,希望提供品牌商在受疫情後時代一個創新的品牌策略方向。

1. 美國電商產業概況:網購加速成長

首先聚焦在美國整體的電商產業,據統計,2020上半年3472.6億美元的營收相較於2019年同期成長了30.1%,遠超2019年12.7%的漲幅(相較於2018)。而線上電商消費在2020前兩季佔了18.6%的整體零售銷售額。

在2020年的第二季度,美國整體零售商產業在電商網絡上花費了2007.2億美元在像是網站維護、訂單處理等項目上,和去年同期相比增長了44.4%(1389.6億美元)。這意味著在4月至6月期間,每5美元的支出中就有1美元來自網上訂單。而電子商務滲透率在第二季度則達到20.8%,高於2019年第二季度的14.7%和2020年第一季度的16.2%。

2. 路邊提貨(Curbside pickup):異軍突起的服務模式

Curbside pickup指的是業者將商品送到顧客車上的服務,若要用一個台灣在地的服務模式做比喻的話,開車去買檳榔就像是用路邊提貨的概念進行銷售。在疫情爆發之後,由Fortune雜誌評選出的全美500強公司(Fortune 500)中的零售商截至8月時提供此項服務的比例為43.7%,相較於2019年年尾的6.9%有非常大的成長幅度。更重要的是,那些在疫情之前就提供這項服務的大型零售商,像是Target Corp. (備註一)以及Home Depot Inc. (備註二),都在2020第二季的營收有很大的成長。前500大企業之一的Target Corp.(第12名)表示,截至8月1日的第二季度,路邊提貨的網絡訂單量增長了734%。同樣地,Home Depot Inc.(第5名)表示,截至8月2日為止,在第二季度的路邊交付量增長了三位數(%)。

3. 美國Amazon:如虎添翼的電商龍頭

根據Digital Commerce 360對網絡測量公司SameWeb的流量數據分析指出,今年7月,也就是美國多數城市解除封城的當月,美國龍頭電商Amazon的網站流量比2020年2月增加了28.1%,和去年同期相比增長了8.7%。值得一提的是,儘管亞馬遜將其於2019年7月舉行的年度黃金日銷售活動推遲到2020年秋季,但流量仍同比增長。而電商上銷售成長率的前五名品項分別為美食類、家電類、家用品類、玩具遊戲類以及園藝類(圖一)。從這五個品項中可以發現封城對消費者的消費習慣產生了巨大的影響。舉例來說,觀察統計數據的變化便可以發現,長年佔據電商平台銷售排行榜前幾名的服飾類並沒有出現在這份名單中,因為消費者將這些開銷轉移至其他的必須品上,因應封城後不方便的生活。此外,園藝類的出現是源於民眾封城期間為了打發時間而培養出的興趣之一,畢竟民眾在家中能做的事情沒有太多選項,美國居民居許多家庭庭院中也都有自己的草坪或是小花園,因而造就了這個有趣的現象。

如果將每月的流量與上一年的同一月份以及2020年2月的流量進行比較,會發現美國消費者的消費習慣有很大的改變,就算在疫情趨緩後,持續在電商平台購物的消費者的比例還是在持續地成長,顯示疫情對美國消費者的消費習慣已經造成不可逆的變化。(圖二)

綜上所述,美國的電商產業在疫情的「幫助」之下,不管是營收、銷售量、網站流量都有了相當大幅度地成長,顯示了這次的疫情直接導致人們生活習慣的改變,也成為品牌商跨入線上銷售的加速器,想必未來的電商市場會迎來更大的改變,就讓我們拭目以待吧。

參考資料 / References:

1. Fareeha Ali(2020) Charts: How the coronavirus is changing ecommerce (https://bit.ly/2Vh3gKu)

2. The 2nd Quarter 2020 Retail E-Commerce Sales Report (https://bit.ly/37gHbS0)

圖一:疫情發生後,美國消費者在Amazon購買品項的銷售成長率前五名

Figure 1: Top Five Product Categories by Sales Growth on Amazon in the U.S. After the Pandemic

圖二:不同月份間的Amazon網站流量比較

(黃色為去年同期,藍色為2020年2月)

Figure 2: Comparison of Amazon Website Traffic Across Different Months

(Yellow represents the same period last year; blue represents February 2020)

備註一:Target Corporation是美國僅次於沃爾瑪(Walmart)的第二大零售百貨集團。

Figure 2: Comparison of Amazon Website Traffic Across Different Months

(Yellow represents the same period last year; blue represents February 2020)

備註二:The Home Depot是美國一家家庭裝飾品與建材的零售商。

Figure 2: Comparison of Amazon Website Traffic Across Different Months

(Yellow represents the same period last year; blue represents February 2020)