BLOG

天圖觀點

Post-Pandemic Era: The Current State of UK E-Commerce

2020-12-11

The outbreak of COVID-19 has significantly altered daily life, making many once-familiar routines feel out of reach. While numerous industries have suffered negative impacts, e-commerce has been one of the few to benefit. By examining the UK market and Amazon UK, we hope to provide SMEs with a basic overview of the UK’s e-commerce development before and after the pandemic.

1. UK Market Overview: Pandemic-Driven Changes and the Rise of E-Commerce

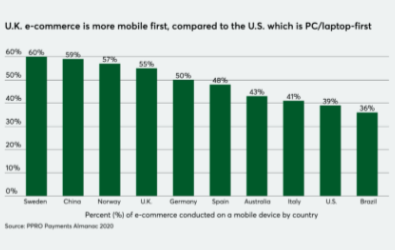

The proportion of UK consumers using mobile phones for online shopping reached 55% in 2020, second only to Sweden (60%), China (59%), and Norway (57%). In comparison, just 39% of U.S. e-commerce sales came from mobile devices. The UK’s high mobile penetration rate of 85%—equal to that of Sweden and Norway and higher than the U.S. (84%), Germany (79%), and China (60%)—plays a significant role in this trend.

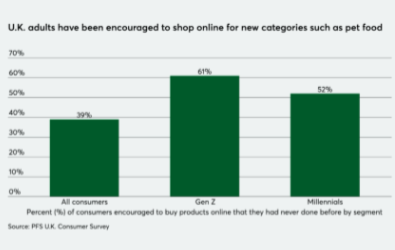

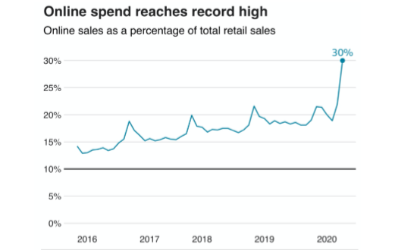

A survey of 2,000 UK consumers by PFS, a provider of e-commerce fulfillment and operations solutions, found that 39% of respondents began purchasing items online during the pandemic that they previously only bought in physical stores—such as pet food and other daily necessities. Younger consumers were especially eager to adopt new online shopping habits: about 61% of Gen Z and 52% of Millennials turned to online channels for necessities and other items during the pandemic (Figure 2). As a result, online sales accounted for a record 30% of total UK retail sales in 2020 (Figure 3), indicating that UK consumers are gradually changing their purchasing habits due to the pandemic.

2. Shortened Delivery Expectations Among UK Consumers

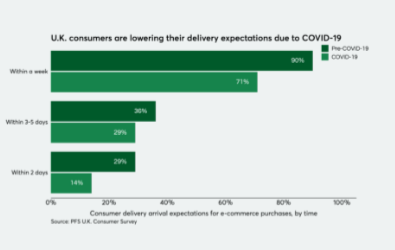

The same PFS survey shows that since the pandemic began, consumers’ expected delivery times for online orders have decreased. Before the pandemic, 90% expected delivery within a week, with 36% expecting 3–5 days and 29% expecting 2 days. Post-pandemic, the proportion expecting delivery within a week fell to 71%, within 3–5 days declined to 29%, and within 2 days dropped to 14% (Figure 4). Consumers understand that the pandemic has disrupted logistics chains, causing delays.

Large order volumes and short turnaround times are one cause of slowed logistics, but a key factor is the new measures retailers have adopted in response to COVID-19. Take Amazon for example: to address pandemic-related issues, Amazon prioritized warehouse space and faster shipping for essential household and medical items. A non-essential product like a guitar may now take nearly a month to arrive. Even Amazon Prime subscribers have to wait at least a week for non-essential items. In unprecedented times, public interest takes precedence over speedy delivery of non-essentials.

3. Growing Acceptance of Alternative Payment Methods (APMs)

As more consumers shop online, including younger users and those who might not have credit cards, alternative payment methods (APMs)—such as “buy now, pay later” services (e.g., Klarna), online banking transfers, and e-wallets—are becoming increasingly popular. Companies like PayPal and MobilePay have also entered the UK market.

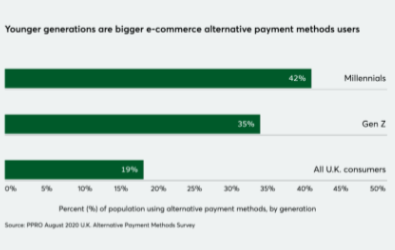

Research by PPRO, a local payments platform-as-a-service company, found that 42% of Millennials and 35% of Gen Z consumers in the UK are confident using or having used APMs. In contrast, only 19% of the general UK population shares that confidence. Almost half (46%) of UK consumers have heard of APMs but never used them, suggesting many remain cautious. Still, 28% say they will or plan to use APMs instead of debit or credit cards within the next two years (Figure 5).

4. Amazon UK: Ongoing Sales Growth for the UK’s Largest E-Commerce Platform

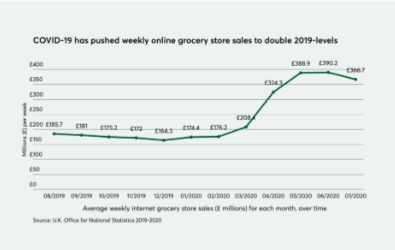

According to the UK’s Office for National Statistics, online grocery sales more than doubled on average during the pandemic. They rose from about £175 million per week (approximately US$231 million) in October 2019 to £366.7 million (about US$484 million) in July 2020 (Figure 6).

Groceries are one of the fastest-growing categories in UK e-commerce, and Amazon’s services are well-aligned with this demand. Nearly nine in ten (86%) UK consumers are Amazon users, and about four in ten (39%) have Amazon Prime. For the Seattle-based e-commerce giant, this makes the UK market ripe for all types of product sales.

In Summary

Even as the pandemic gradually eases and lockdown measures lift, the consumption habits forged under COVID-19 remain. This irreversible digital transformation has affected both businesses and consumers. Moreover, the UK experienced another surge in cases toward the end of the year, prompting another lockdown. According to research by eBay Advertising, 27% of consumers started their Christmas shopping early, and spending during the holiday season was more interest-driven than ever. During lockdown, 56% of surveyed consumers picked up new hobbies, and 75% planned to continue them post-lockdown. Gardening and baking proved most popular. It remains to be seen how this trend will influence the e-commerce industry’s development during the winter of 2020 and beyond.

後疫情時代:英國電商發展現況

新冠肺炎疫情的爆發,大幅地影響了人民的生活,許多本來習以為常的生活,現在似乎變得遙不可及,而有相當多的產業都受到巨大的負面衝擊,但電商卻是少數得益於疫情的產業。我們以英國市場和Amazon UK為標的,分析了疫情前後英國電商發展的比較,希望提供中小企業一個淺面的英國電商發展概況分析。

1. 英國市場概況:疫情驅動的改變,電商市場的崛起

英國人民使用手機作為線上購物的載具的比例非常高,在2020年達到了55%,僅次於瑞典(60%)、中國(59%)以及挪威(57%),而相較之下,世界第二大的電商市場美國僅僅只有39%的電商銷售來自於手機。(圖一)而原因很大一部分來自英國的手機普及率達到85%,和瑞典以及挪威是一樣的比例,比美國(84%)、德國(79%)還有中國(60%)都要來得高。

根據電子商務訂單履行和運營解決方案提供商PFS對2,000名英國消費者的調查發現,有39%的受訪者表示,他們開始在線上購買以前只會親自到實體商店購買的商品包含像是寵物食品等的民生用品,而年輕消費者使用電商等新型態購買方式的意願最為強烈。疫情爆發期間,大約61%的Z世代消費者和52%的千禧世代消費者開始轉向在線上購物,購買品項如民生用品、寵物用品等,也藉機拓展出新的消費習慣。(圖二)而英國線上銷售量佔整體零售銷售量的比例也在2020年達到了歷史新高的30%(圖三)顯示了英國的消費者因為疫情的影響已經在慢慢的改變他們的消費習慣。

2. 英國電商消費者的預期到貨時間降低

同一份PFS調查報告顯示,自疫情爆發開始至今,消費者對於線上購物的預期到貨時間有下降的趨勢。在疫情爆發之前,有90%的消費者的預期到貨時間是在一周之內到達,有36%的消費者的預期到貨時間在三到五天之內到貨,而有29%的消費者希望他們購買的商品在兩天內到達。疫情發生後,預期到貨時間在一周之內的消費者由90%下降到71%,預期到貨時間在三到五天之內的消費者由36%下降到29%,而預期到貨時間在兩天內的消費者由29%下降到14%。(圖四)三個項目的佔比都有明顯幅度的下滑,顯示消費者自身也瞭解到疫情劇烈影響到物流產業的出貨時間。

雖然短時間且大量的訂單的確是零售商的物流速度下降的主因之一,不過造成此現象最大的原因卻是來自於零售商面對疫情的肆虐所祭出的新措施。

以全球電商龍頭Amazon為例,為了因應疫情帶來的影響,他們決定將倉儲空間優先留給民生必需品以及醫療相關用品,而這些用品也會以較快的速度出貨。如果你今天訂購的是一把吉他,想要在居家隔離的時候解解悶,那你可能必須等上將近一個月才能夠收到那把吉他。有些人可能會這樣想:「如果訂購Amazon Prime的話不就能夠搶先拿到了嗎?」,很抱歉,在疫情期間就算你是Amazon Prime的用戶,你還是必須等上至少一個禮拜才會拿到你訂購的「非」民生必需品,畢竟在這疫情肆虐的非常時期,必須以公共利益的最大化為優先考量。

3. 英國消費者開始接受更多元的付款方式

隨著越來越多的消費者在線上購物,尤其是年輕的消費者以及可能無法使用信用卡的消費者,其他付款方式(Alternative Payment Method, 以下簡稱APM),像是立即購買,日後付款計劃(例如,Klarna) ,以及網路銀行轉帳和電子錢包,已經越來越受歡迎。許多新的APM公司,像是PayPal、MobilePay等等都已經加入英國市場。

PPRO,一家本地支付服務平台公司(local payments platform-as-a-service),最近針對英國消費者進行的一項調查發現,有42%的千禧世代和35%的Z世代對使用或曾經使用過APM充滿信心,而英國普通消費者只有19%。由於許多APM最初都是針對電商或全通路(線上+線下)商家做服務,像是Amazon、阿里巴巴的電子商務部門,因此這些參與者準備從英國電子商務市場的增長中受益。

英國將近一半(46%)的消費者聽說過APM,但沒有使用過,代表部分消費者還在觀望APM的可行性亦或是認為做出改變的機會成本遠大於維持現在的支付方式的機會成本。而28%的消費者表示,在未來兩年內,他們將使用或計劃使用APM而不是藉簽帳卡或信用卡。(圖五)

4. Amazon UK:英國境內最大的電商平台營業額持續飆升

根據英國國家統計局的數據,在疫情期間,雜貨的線上銷售量平均每週相比疫情前增加了一倍以上,從2019年10月的每週約1.75億英鎊(約2.31億美元)的銷售額增加到2020年7月份的3.667億英鎊(約4.84億美元)的銷售額。(圖六)而在英國,其中一個線上購物比率持續增長的電子商務類別是雜貨(原文為grocery,以生活用品、食品為大宗),而Amazon 提供的服務完美的符合英國人民的需求。根據研究諮詢公司Mintel的數據,近十分之九(86%)的英國消費者是亞馬遜的用戶,大約十分之四(39%)的用戶可以使用Amazon Prime,因此這家總部位於西雅圖的電子商務巨頭將成為所有產品的直接受益者。

綜上所述,可以看到即使在疫情逐漸趨緩,各國在封城解禁之際,原本因為疫情影響所被迫改變的消費習慣依然存在,顯示這波疫情導致的數位轉型,無論是對企業還是人民都帶來不可逆的改變。此外,英國的疫情嚴重程度又在近日達到了另一波的高潮,英國政府在年底甚至又再一次宣佈封城。而根據eBay Advertising做的研究指出,有27%的消費者決定提早開始他們耶誕節的購買,而eBay也指出,今年在電商平台上的消費會更多傾向於興趣導向,這是由於研究數據指出有56%的消費者(被調查的)在封城和居家隔離的期間發展出新的興趣,在這其中又有75%的人表示他們會持續耕耘他們的興趣,園藝以和烘焙則是這當中兩個最受歡迎的項目。這個趨勢是否會持續牽動2020年冬天電商產業的發展呢?就讓我們拭目以待吧。

參考資料 / References:

1. Michael Moeser(2020)6 ways COVID-19 is changing U.K. e-commerce (https://bit.ly/3ncMzw4)

2. BBC News(2020)Coronavirus: Retail sales crash in April as lockdown hits shops (https://bbc.in/39UXwP8)

3. Rhian Murphy(2020)Retails sales, Great Britain: September 2020 (https://bit.ly/2W2RQKJ)

圖一:2020年各國人民使用手機作為線上購物的載具之比例

Figure 1: Proportion of Consumers Using Mobile Devices for Online Shopping in 2020

圖二:2020年英國不同世代消費者願意在線上購買新商品類別的比例

(由左至右分別為:整體消費者、Z世代、千禧世代)

Figure 2: Percentage of UK Consumers Willing to Purchase New Product Categories Online (Overall, Gen Z, Millennials)

圖三:英國線上銷售量佔整體零售銷售量的比例

Figure 3: Online Sales as a Percentage of Total Retail Sales in the UK

圖四:疫情前後英國消費者的預期到貨時間比較深綠色為疫情前

(淺綠色標記為疫情後)

Figure 4: Comparison of Expected Delivery Times in the UK Before and After the Pandemic (Dark green: Pre-pandemic, Light green: Post-pandemic)

圖五:英國不同世代消費者願意用APM消費的比例

(由上至下分別為:千禧世代、Z世代、整體英國消費者)

Figure 5: Proportion of Consumers in Different Generations Willing to Use APMs (Top to bottom: Millennials, Gen Z, Overall UK Consumers)

圖六:線上雜貨商店的每月銷售量

Figure 6: Monthly Sales Volume of Online Grocery Stores