BLOG

天圖觀點

Post-Pandemic Era: The Current State of Nordic E-Commerce

2021-01-04

In the wake of the pandemic, the world has increasingly gravitated toward “digitalization,” and Europe is no exception. These digital transformations have profoundly influenced consumers, nations, and industries. This article aims to explore the changes brought about by the pandemic, focusing on the European market and key countries in the Nordic region such as Sweden and Denmark. To understand the trends spurred by the pandemic, McKinsey conducted a survey of 20,000 European consumers between April 28 and May 20, 2020. Let’s analyze the post-pandemic state of the Nordic e-commerce market.

European Market Overview:

-

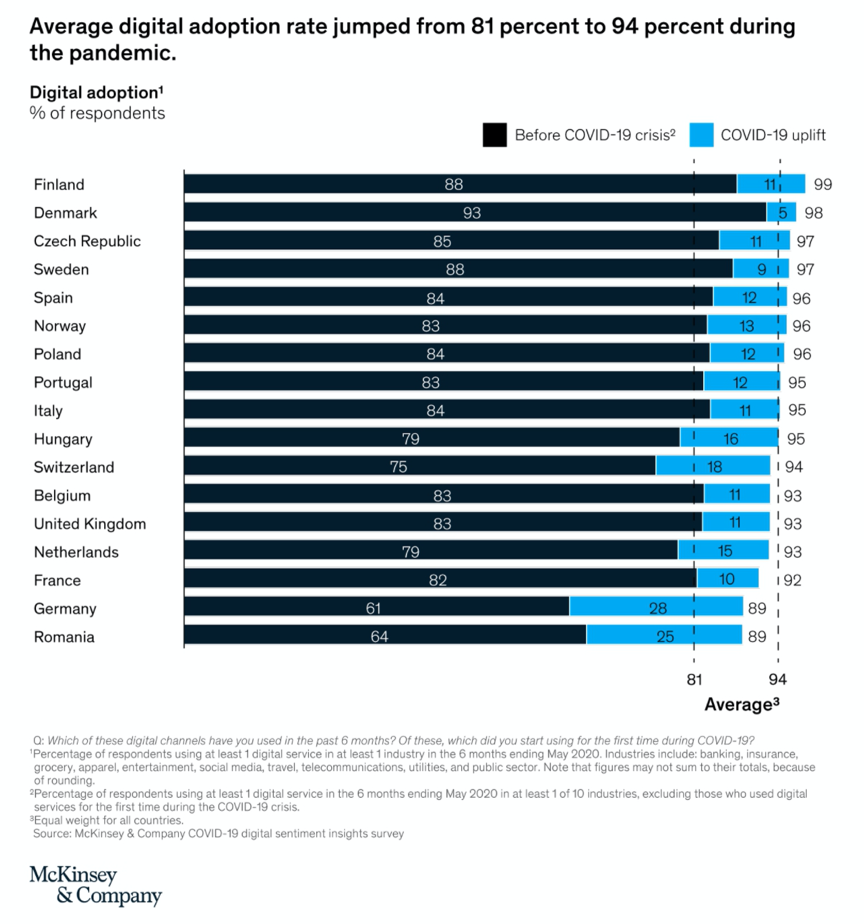

Significant Increase in Digital Adoption Rates

The outbreak led to lockdowns across various countries, halting almost all social activities. As a result, digital channels became the primary means for residents to maintain normal operations in their daily lives. Before the pandemic, digital adoption rates varied significantly from country to country due to factors such as domestic political and economic conditions, national cultures, and public attitudes. On the whole, highly developed Nordic countries already boasted the highest digital adoption rates.Surprisingly, even in advanced Western European countries, digital adoption was generally lower before the pandemic—Germany, for instance, reported only a 61% adoption rate. However, after lockdowns were enforced, every country’s digital adoption rate soared to over 90%. Even Germany, previously on the lower end, grew by 28% to reach an 89% adoption rate. (Figure 1)

-

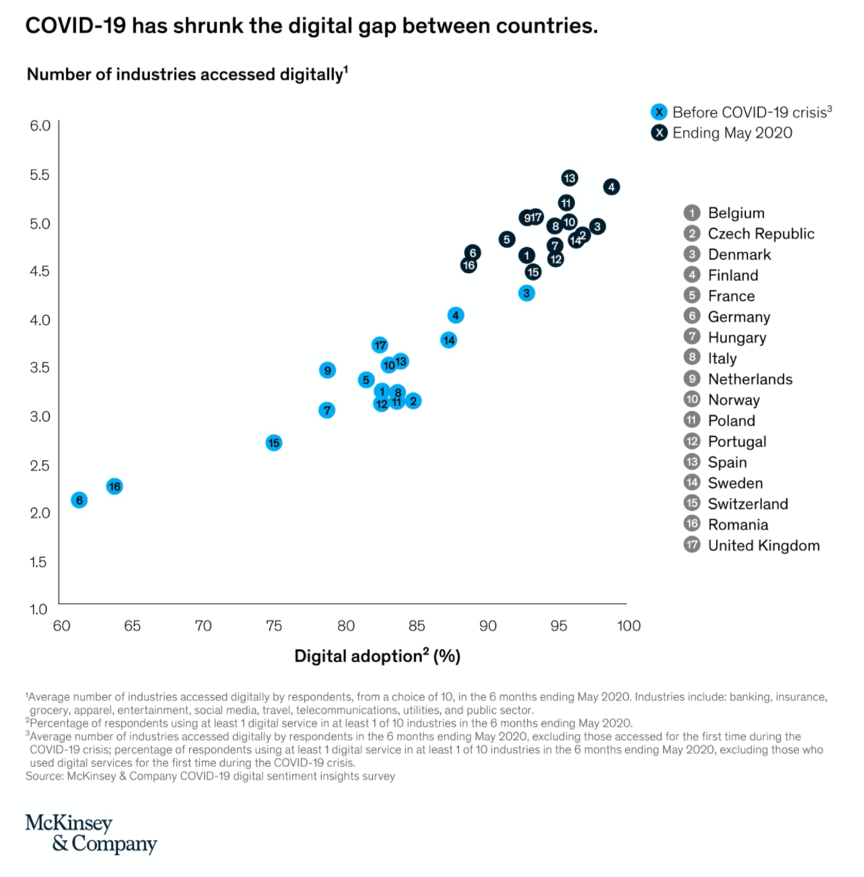

Narrowing the Digital Gap Between Countries

The pandemic also noticeably narrowed the digital gap among European countries in terms of online activities. (Figure 2) This figure compares data before and after the pandemic (up to the end of May 2020). The vertical axis represents the average number of industries (out of ten: banking, insurance, groceries, apparel, entertainment, social media, travel, telecommunications, public utilities, and public services) that consumers engage with through digital channels, while the horizontal axis shows digital adoption rates.Before the pandemic, represented by blue dots, European countries were more scattered, with a digital gap of up to 32%. By the end of May, the gap had shrunk to just 10%. Despite various national contexts, political and economic conditions, cultural habits, and the severity of the pandemic, people’s daily lives were forced to adapt. Increasingly, everyday activities had to be conducted through digital platforms and channels, underscoring the tremendous impact of COVID-19.

Nordic E-Commerce Market Trends Before the Pandemic:

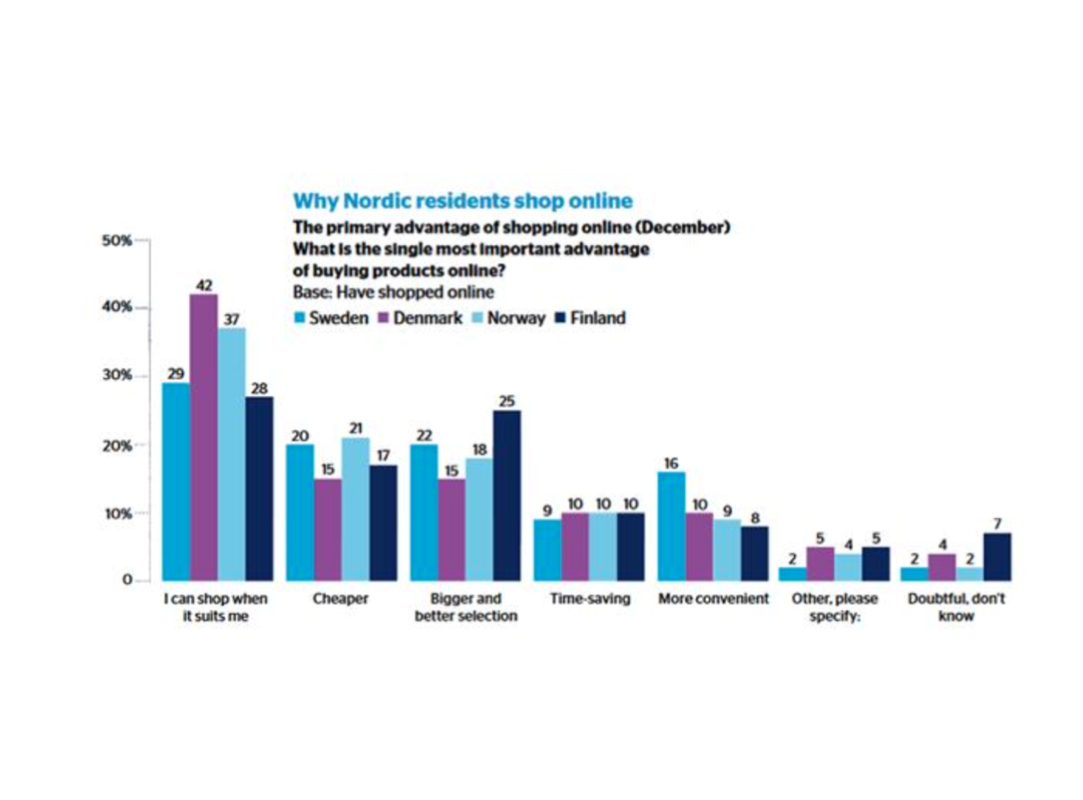

According to a report by PostNord, the Nordic region has long been an active hub of e-commerce and online shopping. Several factors contribute to this phenomenon (see Figure 3 for detailed explanations):

- Online shopping has no time restrictions.

- Price advantages.

- Greater product variety.

- Time-saving convenience.

- Overall convenience.

Though the four Nordic countries exhibit different consumption levels, their purchasing habits are quite similar due to cultural influences. Apparel and footwear are the most popular product categories, followed by entertainment and household electronics. In addition to popular e-commerce sites like Amazon, Wish, ASOS, and Etsy, many price comparison websites attract the pragmatic Nordic consumer. The top three are:

- Vertaa (Finland)

- Hintaseuranta (Finland)

- Prisjakt (Finland, Norway, Sweden)

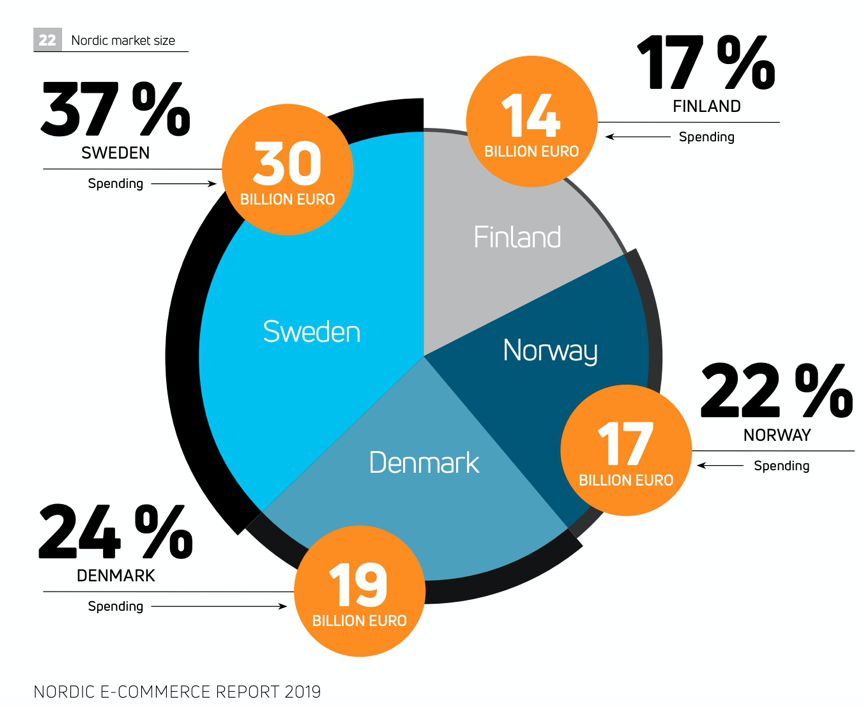

These price comparison platforms complement e-commerce sites. Given the relatively limited variety of domestically produced goods compared to foreign markets, the combination has fostered a strong online shopping culture in the Nordic region. According to PostNord’s annual e-commerce report, total Nordic e-commerce spending in 2019 reached €80 billion. Sweden contributed €30 billion (37% of the total), Denmark €19 billion (24%), Norway €17 billion (22%), and Finland €14 billion (17%). Compared to the €72 billion spent in 2018, the total increased by €8 billion in 2019. (Figure 4)

Changes in Payment Habits: The Rise of Mobile Payments

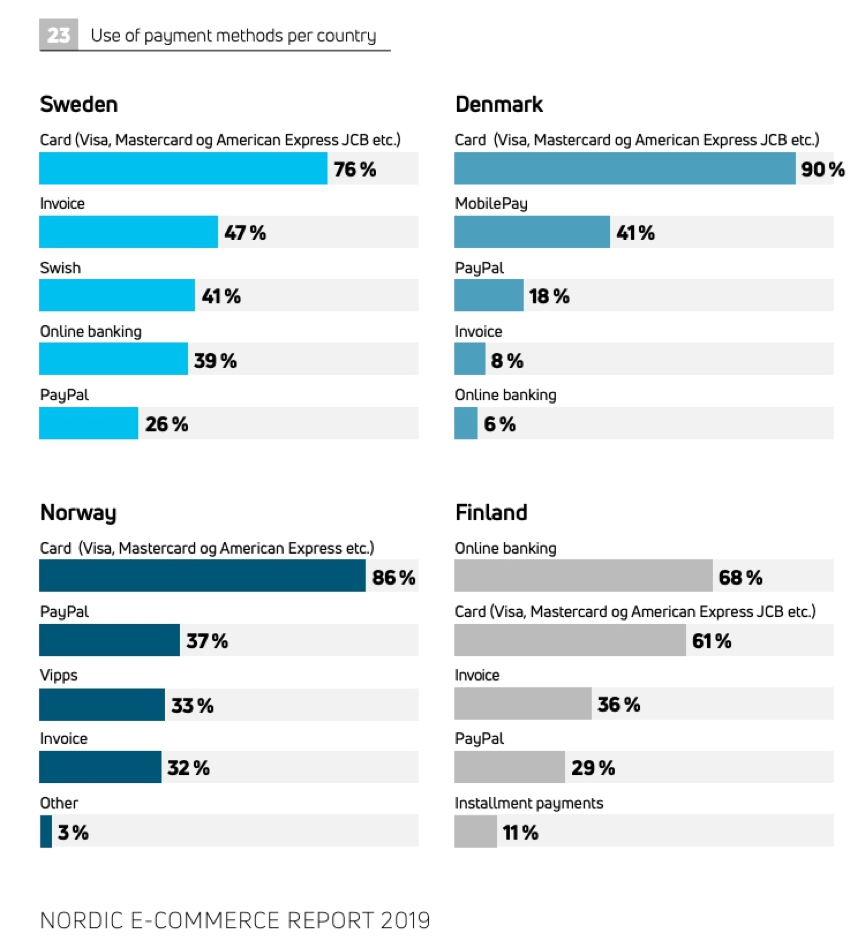

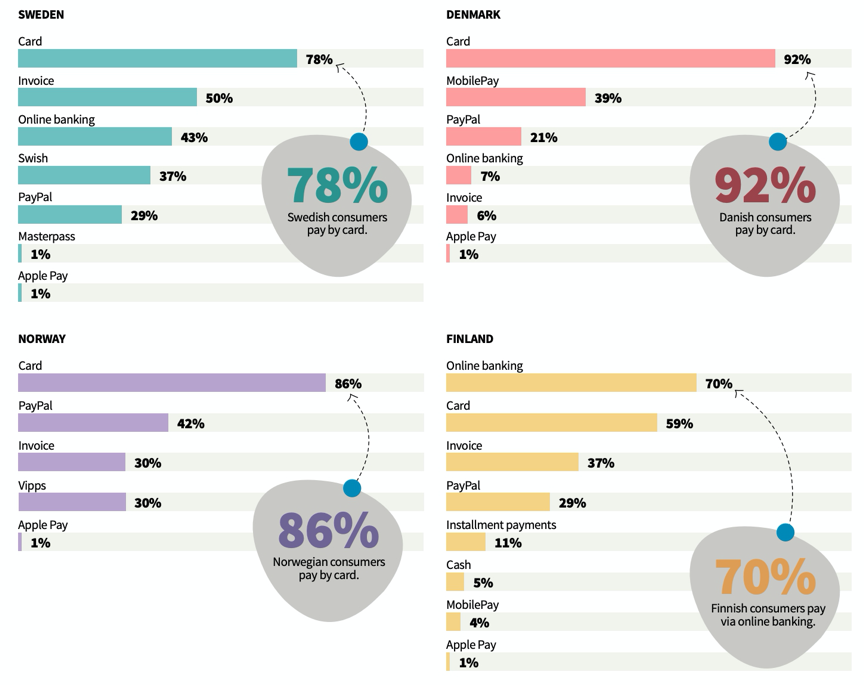

In Norway, Denmark, and Sweden, most consumers prefer to pay by credit card (86%, 90%, and 76% respectively), while Finnish consumers favor online banking—though credit cards also rank second at 61%. However, credit card and online banking usage both declined slightly compared to 2018. In their place, mobile payment options like MobilePay, Swish, and PayPal have risen significantly. In Sweden, the use of Swish rose from 37% in 2018 to 41% in 2019, and in Denmark, MobilePay usage climbed from 39% to 41%. Notably, the 5% of Finns who used cash in 2018 completely disappeared in 2019. (Figures 5 and 6)

Although national conditions influence payment methods slightly, mobile payment usage grew noticeably in 2019, indicating that everyday life in Nordic countries is becoming increasingly digitized.

The Flourishing of Cross-Border E-Commerce

Why?

Nordic consumers love shopping on cross-border e-commerce platforms. We can attribute this to several factors:

- High internet penetration and digital adoption.

- Limited variety of domestic products.

- The desire for the best value products.

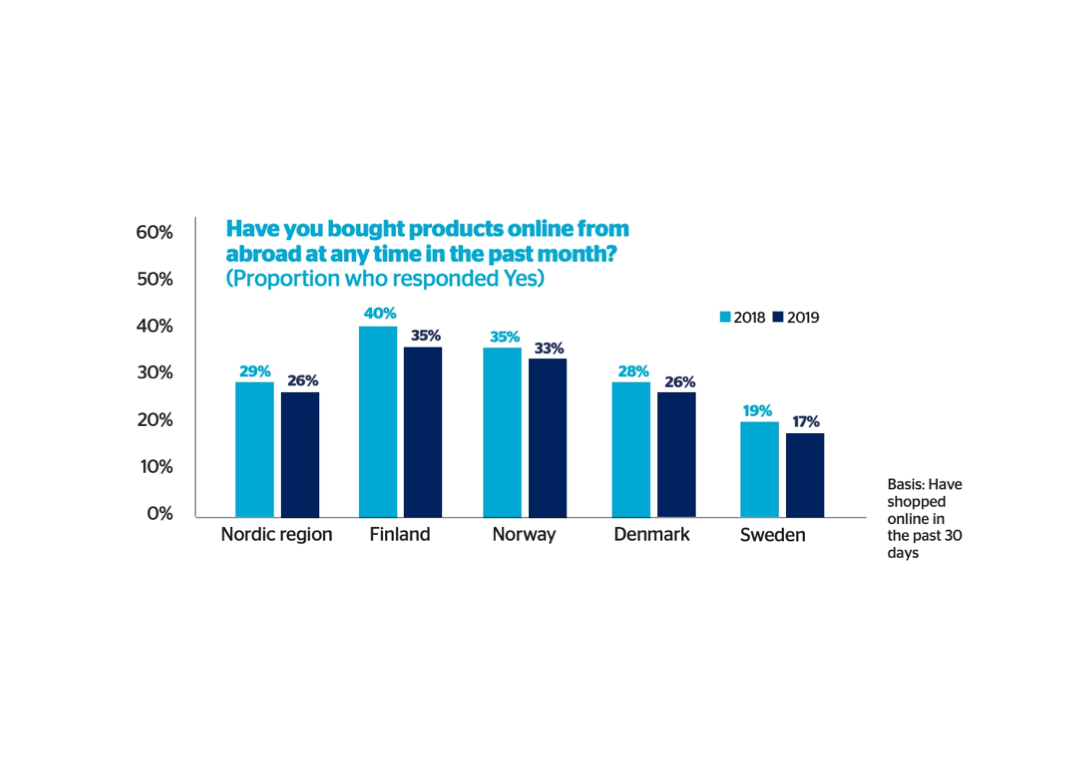

Despite these tendencies, 2019 marked a change. According to PostNord’s research, the proportion of Nordic consumers shopping on cross-border platforms dropped compared to 2018. (Figure 7) Finland saw the largest decline at 5%, and overall cross-border usage fell from 29% to 26%. This suggests that domestic product offerings in Nordic countries have become more diverse, offering better value.

Where?

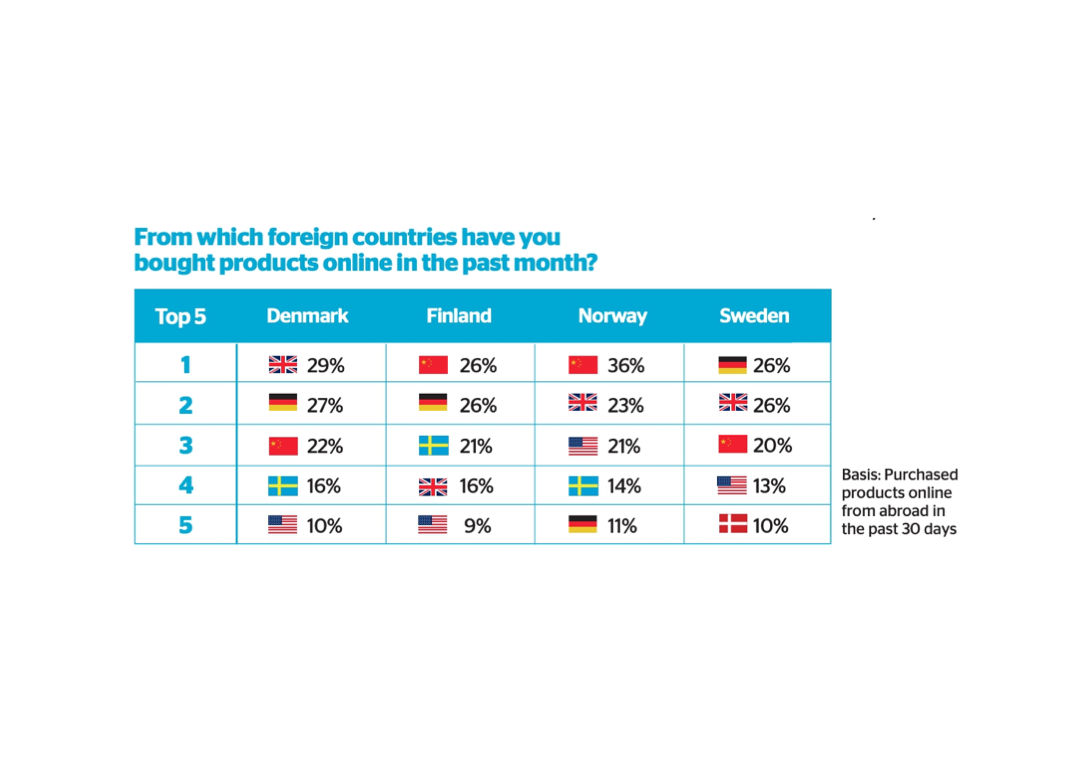

China, Germany, Sweden, the United States, and the United Kingdom are the most popular countries for Nordic consumers’ cross-border e-commerce (Figure 8). Chinese platforms offer diverse and affordable goods like apparel and electronics, which Nordic consumers appreciate. Germany, thanks to e-commerce giants Zalando and German Amazon, also remains a top choice.

Zalando, founded in 2008, is a German fashion e-commerce company that initially emulated the U.S.-based Zappos. Zalando established its foothold in the German market by offering free shipping, a 100-day return policy, and free returns—features tailored to German consumer habits. Although Germans were initially slow to embrace online shopping, they were frontrunners in returning items purchased online. PostNord’s 2018 data shows that 53% of German online shoppers returned items, the highest rate in Europe. Moreover, German e-commerce rules often allow payment after delivery, making returns even easier. A study by the University of Bamberg found that Germans returned goods worth about €5.5 billion last year. Among Nordic countries, Sweden is the neighbors’ favorite place to shop online.

What?

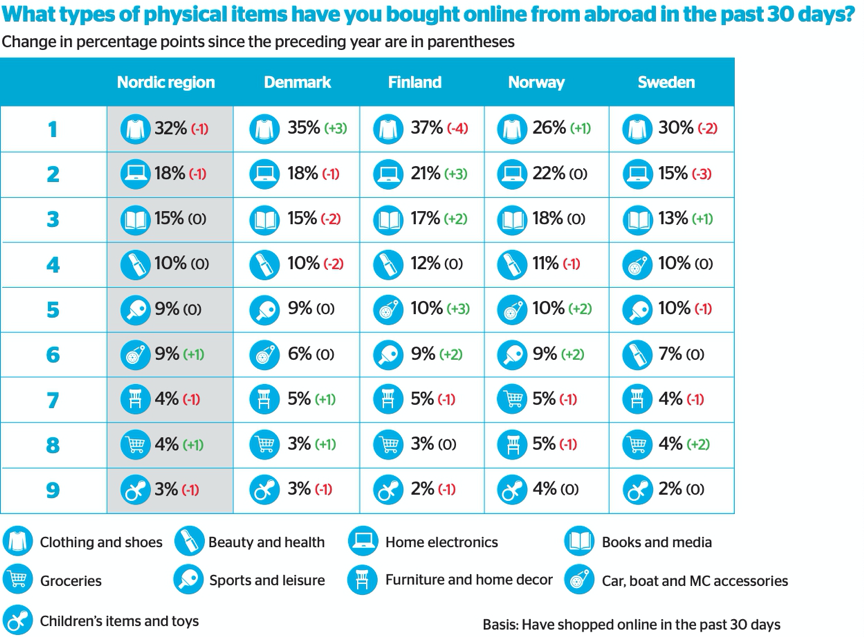

Examining cross-border e-commerce preferences (Figure 9) reveals that apparel leads in all four Nordic countries, followed closely by household electronics, and then newspapers and magazines. Interestingly, while consumers typically prefer to buy automotive products domestically, this is reversed in the Nordic countries. We suspect this is due to their proximity to Germany, an industrial powerhouse known for its automotive and technology industries. It’s easy to understand why Nordic consumers adopt such habits.

In summary, the high digital adoption rates in the Nordic region and consumers’ pursuit of value have made this area a prime market for e-commerce giants. The development of the Nordic e-commerce market will continue to warrant close observation and study in the future.

後疫情時代:北歐電商發展現況

在疫情的影響之下,導致全世界逐漸向「數位化」靠攏,而歐洲也不例外,數位化的改變在消費者、國家和產業間都造成了巨大的影響。本篇文章旨在探討疫情所造成的變化,聚焦在歐洲市場以及瑞典、丹麥等等北歐地區指標性的國家。而為了一窺疫情造成的趨勢變化,McKinsey在2020年4月28日到5月20日,針對20,000歐洲消費者展開調查,就讓我們來一一分析北歐電商市場在疫情後的概況吧。

歐洲市場概況:

1. 數位應用率(digital adoption rate)大幅提升:

疫情的爆發導致各國陸續封城,而封城則讓一切的社交活動嗄然而止,數位通路也因此變成維繫各區域居民正常運作的管道。在疫情爆發之前,受到國內政經局勢、國家文化、人民態度等等因素影響,每個國家的數位應用率有滿大的不同,而整體來說,高度發展的北歐國家的數位應用率算是最高的。相較於北歐,較令人意外的是,直覺上我們認為最先進的西歐國家,其數位應用率普遍來說是較低的,尤其是德國,據調查統計只有61%。

不過在疫情爆發、各國政府宣布封城之後,每個國家的數位應用率都有飛躍性地成長,幾乎每個國家都達到90%以上,就連原先比率最低的德國也有了28%的成長,來到了89%的數位應用率。(圖一)

2. 各個國家間Digital gap 的縮小:

就線上活動而言同樣有著明顯變化的是疫情導致歐洲各國間的digital gap縮小的程度。(圖二)此圖表為疫情前vs疫情後(截至2020年5月底)的數據比較,縱軸為消費者會透過數位管道接觸的產業的平均數量(10個產業標的,分別為:銀行、保險、雜貨、服飾、娛樂、社群、旅遊、通訊、公營事業、公共服務),橫軸為數位應用率。從圖上可以看到藍色的圓點,也就是疫情前的分佈較為分散,歐洲各國間的digital gap較大,最大的數位應用率差距甚至達32%。但是在5月底時,這個差距縮小到只有10%,顯示了就算考慮了國情、政經局勢、疫情嚴重程度甚至文化習慣等外在因素,人們的生活習慣因為新冠疫情的爆發還是被迫做出了改變,越來越多的日常活動都必須在數位平台和數位通路上進行,直接驗證了疫情對各國造成的巨大影響。

疫情爆發前的北歐電商市場趨勢:

根據瑞典郵政(PostNord)的報告指出,北歐地區一直以來都是電商以及網路購物較為活躍的地區,而這種情況出於以下幾個原因,分別為(詳細的說明請見圖三):

1. 網購沒有時間限制

2. 價格優勢

3. 更多的產品選擇

4. 節省時間

5. 方便

雖然北歐四國人們的消費水平各不相同,但由於文化方面的相互影響,購買習慣卻十分相似。其中服飾和鞋類是最受歡迎的品項,其次是娛樂以及家用電子產品。而除了Amazon、Wish、ASOS、Etsy這些在北歐受歡迎的電商網站之外,因為北歐人務實的個性,許多比價網站受到當地消費者的青睞,前三名分別為:

1. Vertaa(芬蘭)

2. Hintaseuranta(芬蘭)

3. Prisjakt(芬蘭、挪威、瑞典)

這些比價網站和電商網站相輔相乘,再加上北歐五國國內生產的商品品項和國外相較之下較不豐富,因此塑造了北歐人熱愛網購的消費文化。根據瑞典郵政(PostNord)的年度電商報告顯示,2019年的瑞典電商消費總額來到了800億歐元,而在這800億中,瑞典貢獻的300億佔了總額的37% ; 丹麥貢獻的190億佔了總額的24% ; 挪威貢獻的170億佔了總額的22% ; 而芬蘭貢獻的140億則佔了總額的17%。在整體成長趨勢方面,2019年的消費總額和2018年的720億歐元相比整整多了80億。(圖四)

付費習慣改變:異軍突起的行動支付

挪威、丹麥、瑞典的消費者絕大多數習慣用信用卡(card payment)在電商消費,比例依序為86%、90%、76%,而芬蘭的消費者則喜歡使用網銀(online banking)作為他們的支付首選,不過信用卡也以61%位居第二。然而,不管是信用卡還是網銀,其佔比和2018年相比都有所減少,取而代之的則是MobilePay、Swish、PayPal等行動支付的崛起。在瑞典使用Swish作為支付手段的比例從2018年的37%提升至2019年的41% ; 在丹麥使用MobilePay作為支付手段的比例從2018年的39%提升至2019年的41%,而我們可以發現在芬蘭2018年使用現金作為支付工具的那5%人在2019年完全消失。(圖五、圖六)

我們認為,雖然因為國情的因素讓北歐四國的支付手段有些許的不同,不過整體而言,在2019年以行動支付作為支付手段的消費者人數有明顯的成長趨勢,顯示了北歐人民的日常生活逐漸向數位化靠攏。

跨境電商的興盛

Why?

北歐四國的消費者非常喜歡在跨境電商平台消費,我們認為可以歸咎於以下幾個因素:

1. 高度的網路普及率、數位應用率

2. 國內提供的商品類別較不豐富

3. 想尋找性價比最好的產品

雖說如此,這種情況似乎在2019年發生了改變。透過PostNord瑞典郵政的調查我們可以發現,北歐四國在2019年有在跨境電商平台上消費的人數比例相較於2018年都有所下降(圖七),其中芬蘭5%的差距是北歐四國中最高的,而整體來說從2018年的29%下降到2019年的26%。筆者認為這種趨勢顯示了北歐四國國內提供的商品品項變得越來越豐富,性價比也越來越好。

Where?

此外,中國、德國、瑞典、美國、英國為北歐四國的消費者最常進行跨境電商消費的國家(圖八),其中可以看到中國多樣且便宜的商品諸如:服飾、家用電子產品等都深得北歐消費者的青睞,而德國則因為Zalando以及German Amazon這兩個電商龍頭成為排行榜前幾名的常客。

Zalando為德國一家時尚電子商務網際網路公司,成立於2008年,從模仿美國知名電商Zappos起家。在創立初期,他們秉持著「免運費」、「100天的退貨期」、「免費退貨」等精神在德國地區站穩腳跟,而這也是為了配合德國人的消費習慣。雖然德國人對網購這件事的接受速度很慢,但他們在退貨方面卻走在了前列。瑞典郵政(PostNord)2018年的統計數據顯示,在線上購物的退貨人數統計中,德國人佔了53%,位居歐洲各國之首。此外,德國電商的規則是貨到後才付款,在收到貨品後消費者已經決定好要留下哪些商品,這無疑讓退貨變得更加容易。班貝格大學(University of Bamberg)的一項研究發現德國人去年退回了價值約55億的商品。此外,同份調查也指出,在北歐四國當中,瑞典是鄰居們最喜歡進行線上購物的國家。

What?

北歐四國的消費者在跨境電商上的消費偏好也值得探討,在圖九中我們可以發現,服飾類在全部四個國家之中都佔有最高的比例,而緊隨其後的則是家電類商品,第三名則是報章雜誌類。我們也發現一個有趣的現象:一般來說,消費者會偏好在國內購買汽機車等交通工具相關的商品,但在北歐四國這個情況卻恰恰相反,我們猜測這和北歐鄰近於德國這個工業大國有很大的關聯,由於德國的汽車工業和科技產業在世界享有盛名,也因此不難理解為什麼北歐的消費者會有這樣的消費習慣。

綜上所述,北歐四國的高數位應用率和消費者追尋高性價比的性格造就了北歐成為區域中電商巨擘極力搶佔的市場,因此該地區的電商市場發展也值得我們持續觀察和了解。

參考資料 / References:

1. 連連跨境支付LianLian(2019)發表於每日頭條 北歐最受歡迎的10個電商網站,跨境人的逆襲之路又寬了 (https://bit.ly/3rLbqKd)

2. Nets(2019)Nordic e-commerce 2019 (https://bit.ly/3nbol4s)

3. Nets(2018)Nordic e-commerce 2018 (https://bit.ly/35olhw3)

4. PostNord(2019)E-commerce in the Nordics (https://bit.ly/3hCNQuu)

5. PostNord(2018)E-commerce in the Nordics (https://bit.ly/3b61UeM)

6. McKinsey Digital(2020)Europe’s digital migration during COVID-19: Getting past the broad trends and averages (http://mck.co/3pKaRyd)

圖一:歐洲各國在疫情前後的數位應用率(digital adoption rate)比較

(深藍色為疫情前,淺藍色為疫情後,統計截至2020年5月底)

Figure 1: A Comparison of Digital Adoption Rates Across European Countries Before and After the Pandemic

(Dark blue represents pre-pandemic data; light blue represents post-pandemic data, with statistics recorded through the end of May 2020.)

圖二:歐洲各國在疫情前後的digital gap比較

(橫軸為數位應用率,縱軸為消費者會透過數位管道接觸的產業的平均數量;共統計10個產業標的,分別為:銀行、保險、雜貨、服飾、娛樂、社群、旅遊、通訊、公營事業、公共服務;淺藍色的圓點為疫情前 ,深藍色的圓點為疫情後,統計截至2020年5月底)

Figure 2: Comparison of the Digital Gap in European Countries Before and After the Pandemic

(Horizontal axis: digital adoption rate; vertical axis: average number of industries accessed through digital channels. Ten industries are included: banking, insurance, groceries, apparel, entertainment, social media, travel, telecommunications, public utilities, and public services. Light blue dots represent pre-pandemic data, and dark blue dots represent post-pandemic data, with statistics recorded through the end of May 2020.)

圖三:北歐四國消費者進行線上購物的原因

(四個顏色由左至右分別為瑞典、丹麥、挪威、芬蘭)

Figure 3: Reasons for Online Shopping Among Consumers in the Four Nordic Countries

(Four colors from left to right represent Sweden, Denmark, Norway, and Finland.)

圖四:2019年北歐四國的電商市場消費總額

Figure 4: Total E-Commerce Expenditure in the Four Nordic Countries (2019)

圖五:2019年北歐四國不同支付手段的比例

(由上至下,左至右分別為:瑞典、挪威、丹麥、芬蘭)

Figure 5: Distribution of Different Payment Methods in the Four Nordic Countries (2019)

(From top to bottom, left to right: Sweden, Norway, Denmark, Finland)

圖六,2018年北歐四國不同支付手段的比例

(由上至下,左至右分別為:瑞典、挪威、丹麥、芬蘭)

Figure 6: Distribution of Different Payment Methods in the Four Nordic Countries (2018)

(From top to bottom, left to right: Sweden, Norway, Denmark, Finland)

圖七,在上個月是否有在跨境電商購物的經驗的比例

(淺藍色為2018年,深藍色為2019年)

Figure 7: Percentage of Consumers Who Purchased from Cross-Border E-Commerce in the Past Month

(Light blue: 2018, Dark blue: 2019)

圖八:北歐四國消費者在各國家電商平台進行線上消費的比例前五名

Figure 8: Top Five Countries Where Consumers in the Four Nordic Countries Shop on Foreign E-Commerce Platforms

圖九:北歐四國消費者線上購物的商品類別排名

(品項由左至右,上至下分別為:服飾類、健康美容類、家電類、報章雜誌書籍類、雜貨類、運動休閒類、家具以及家用品類、交通工具類、兒童商品及玩具類;其中雜貨包含食物如餅乾、麥片、乾糧等,健康美容類包含化妝品、保養品、保健食品等,家用品類包含清潔用品、消耗品、廚房用品等)

Figure 9: Ranking of Product Categories for Online Shopping in the Four Nordic Countries

(Arranged from left to right, top to bottom: Apparel, Health & Beauty, Electronics, Newspapers/Magazines/Books, Groceries, Sports & Leisure, Furniture & Home Goods, Transportation, and Children’s Products & Toys.

- Groceries include foods such as cookies, cereal, and dried goods.

- Health & Beauty includes cosmetics, skincare products, and dietary supplements.

- Home Goods include cleaning supplies, consumables, and kitchen utensils.)